Proxy Market Research 2022

For four years running, Proxy Market Research remains the largest – and only! – in-depth evaluation of the leading proxy services. Though focused on technical benchmarks, the research gives a complete overview of the providers, along with a glimpse into the broader state of the market. It can benefit anyone using or considering a proxy service, whether you’re an individual in need of proxies, a business, or a proxy seller looking to improve your products.

This year’s research covers 11 providers. These include companies like Bright Data, Oxylabs, and Smartproxy, which constitute the lion’s share of the market, together with smaller services like IPRoyal and PacketStream. We aim to make as broad a representation as possible while keeping the scale manageable.

Compared to the previous year, the 2022 edition makes a few changes. First, it benchmarks more products: not only residential, but also dedicated datacenter and mobile proxies – even several web scrapers. Second, it puts greater emphasis on individual country pools to more accurately evaluate the proxy networks. And finally, it comes as a web page (and not a .pdf!) to make the content more interactive. For those who want it, a .pdf version will be available at a later date.

Key Findings

Market Trends

- Datacenter and residential proxies remain the most popular proxy types, with 95% of use. But proxy-based APIs are quickly picking up the pace.

- Businesses mostly buy proxies to collect data from e-commerce and travel websites, monitor their marketing performance on search engines, and help with their ad efforts.

- Last year brought many small mobile proxy shops, while sneaker scalping experienced a major hit due to fewer releases and tightening security.

- Providers released five new bandwidth sharing apps in effort to source IPs more transparently.

- Providers are still fighting in court over the right to provide residential proxy services.

General Evaluation

- You can find the evaluation graph here.

Dedicated Datacenter Proxies

- Most datacenter proxy services charge for IPs, while giving unlimited traffic and connection requests. Bright Data uses the most imaginative pricing model, which also includes the number of available domains, gigabytes, and even ability to target cities.

- Some providers demand up to 60% more for proxies outside of the US.

- Datacenter IPs are fast: they reached popular targets 2-3 times faster than residential addresses (1.75 response time on average). However, they also got blocked more, especially on targets like Amazon and Craigslist.

- IPRoyal’s proxies were the fastest, while Blazing SEO and Oxylabs displayed the best overall success rates.

- All in all, Blazing SEO has the most balanced service, while Oxylabs should appeal to premium customers.

Residential Proxies

- Residential proxy services can be pretty clearly segmented into cheap, mid-level, and premium. The cheapest providers cost up to 10 times less than the premium ones.

- Nearly all providers are able to connect with over 90% success rate. Real performance differences manifest in response time, which depends on IP location. The fastest providers are three times faster than the slowest ones.

- Pool size is another differentiating criterion that very much favors the premium providers. Bright Data, Oxylabs, and Smartproxy had IP pools that were both larger and better balanced than most competitors.

- Nowadays it’s easy to find companies with over 100 locations, city targeting, and flexible rotation options. ASN targeting, however, remains a rare premium feature, and more than half of the participants fail to support SOCKS5.

- Residential proxy services still run on traffic-based subscriptions, and paying as you go is relatively rare.

- Overall, Bright Data, Oxylabs, and Smartproxy remain the best residential proxy providers.

Mobile Proxies

- Peer-to-peer mobile proxy services are few and far between compared to services that use dedicated devices.

- They’re significantly more expensive than residential IPs ($42.50 vs $13.64 at 5 GBs of data) but the differences between providers are not as pronounced. The dominant pricing model is traffic-based subscription.

- With one exception, the proxy networks have nearly perfect success rates but connect half as fast as residential addresses. Oxylabs is the exception: its proxies outperformed 7 residential (!) proxy services.

- Mobile proxy pools are generally smaller. But the marketing numbers can’t always be trusted: SOAX had more unique IPs than Bright Data despite having half the advertised pool. Oxylabs won the comparison by a large margin.

- Blazing SEO uses a unique model that constantly rotates dedicated devices. It performed poorly due to being a beta service but generated a large number of IPs over time with a limited number of devices. This shows interesting opportunities for web scraping tasks that value IP uniqueness over speed.

- Overall, Oxylabs convincingly displayed the best results in most categories but price.

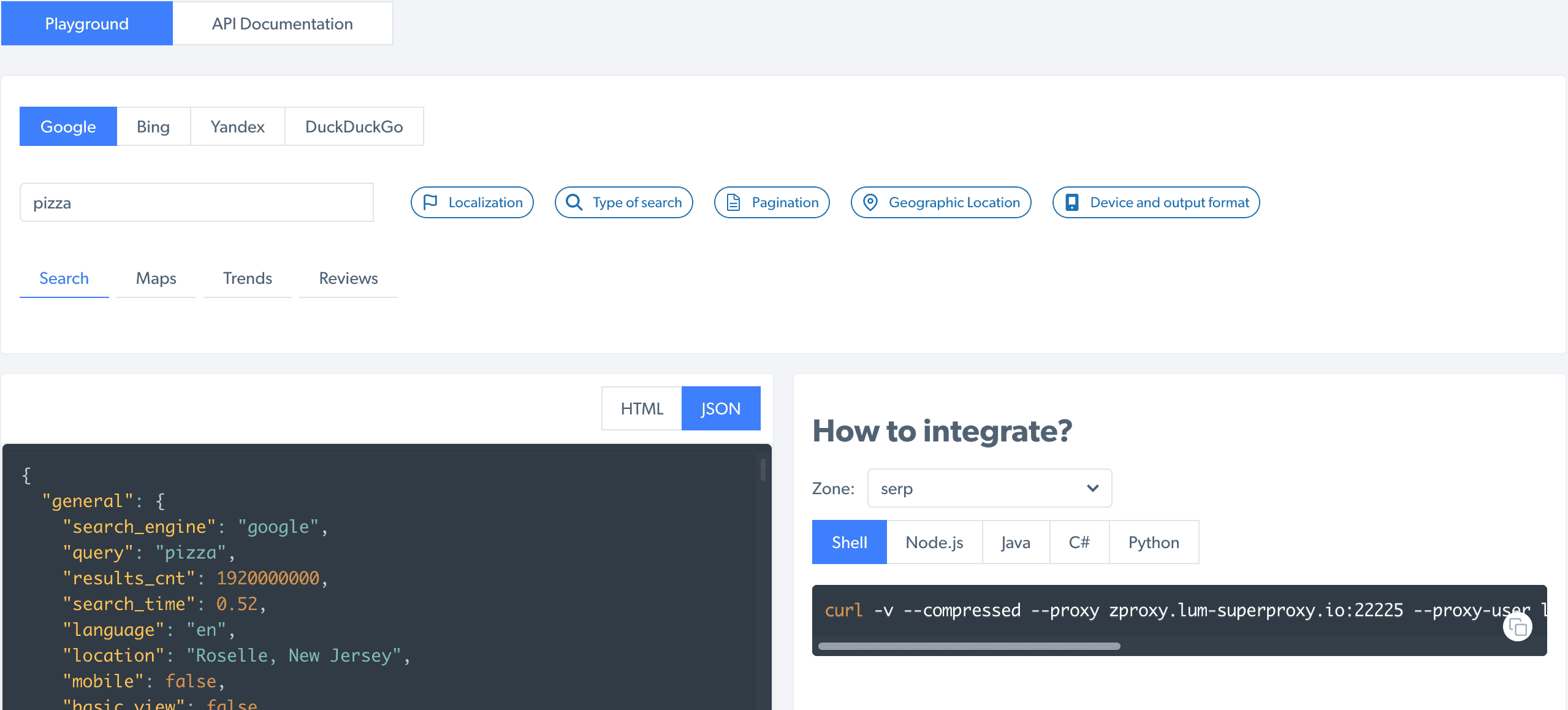

Proxy-Based APIs

- Proxy-based APIs add web scraping logic onto proxy networks to retrieve data with 100% success. Providers like Bright Data and Oxylabs have made them the only way to access certain protected websites.

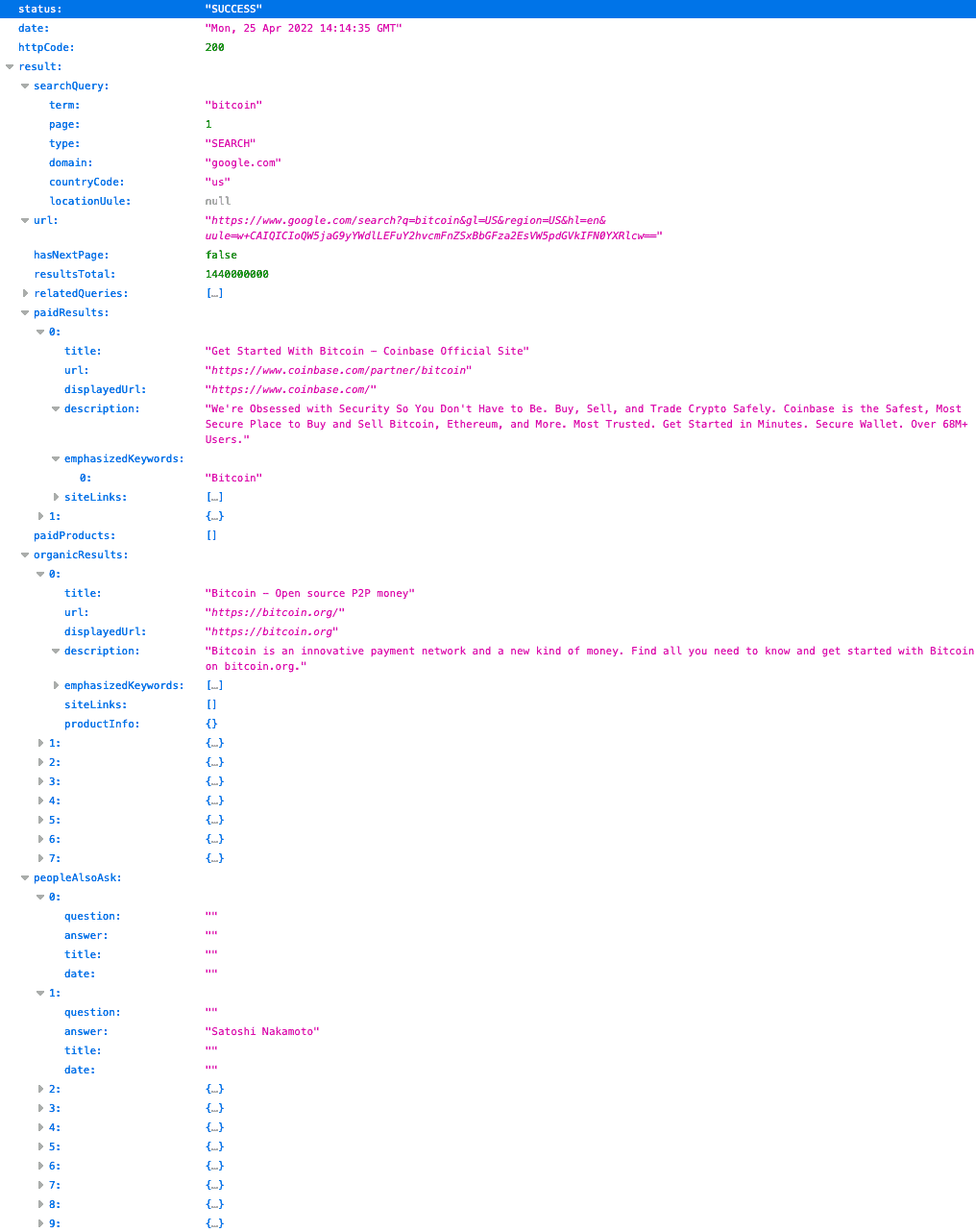

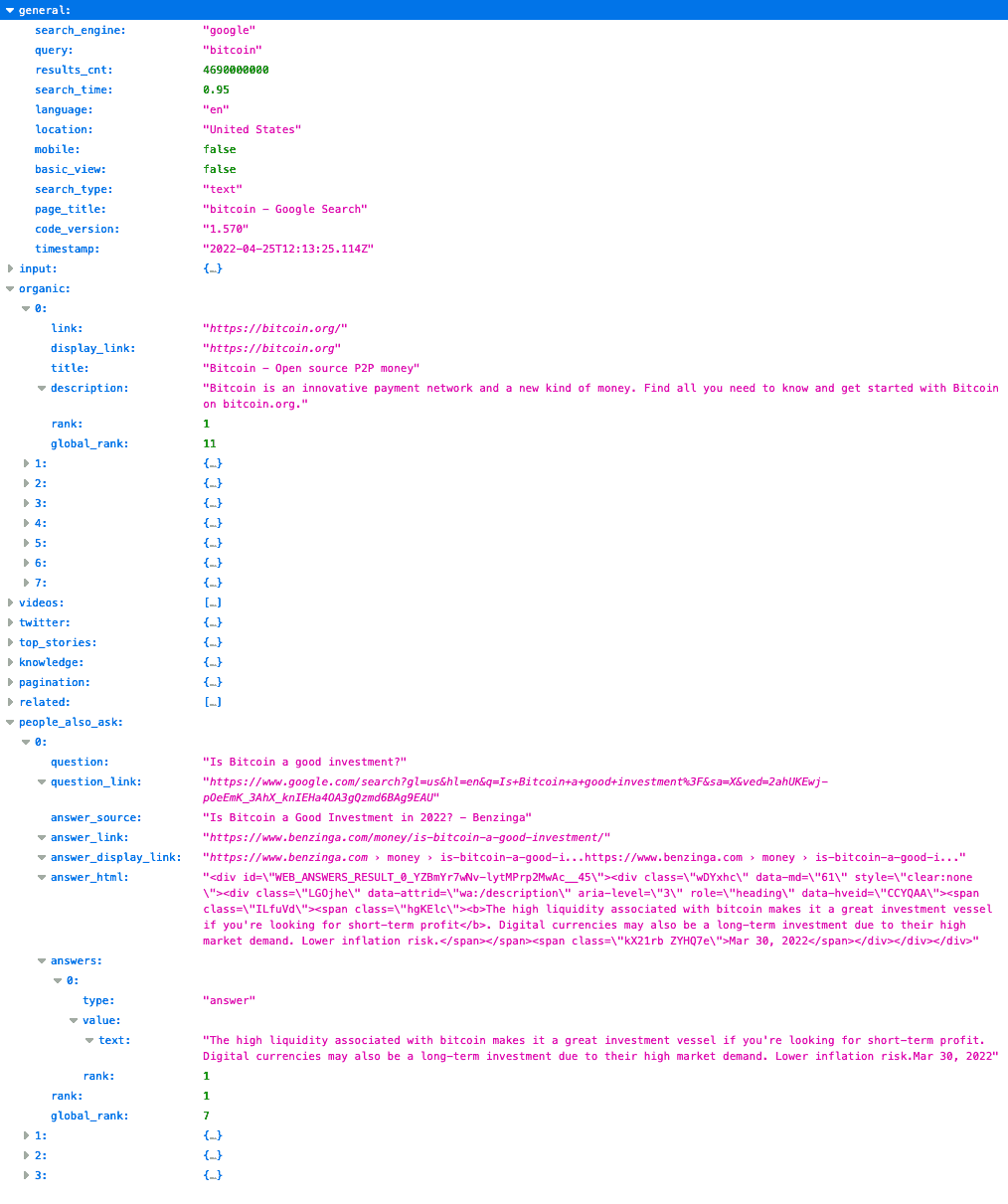

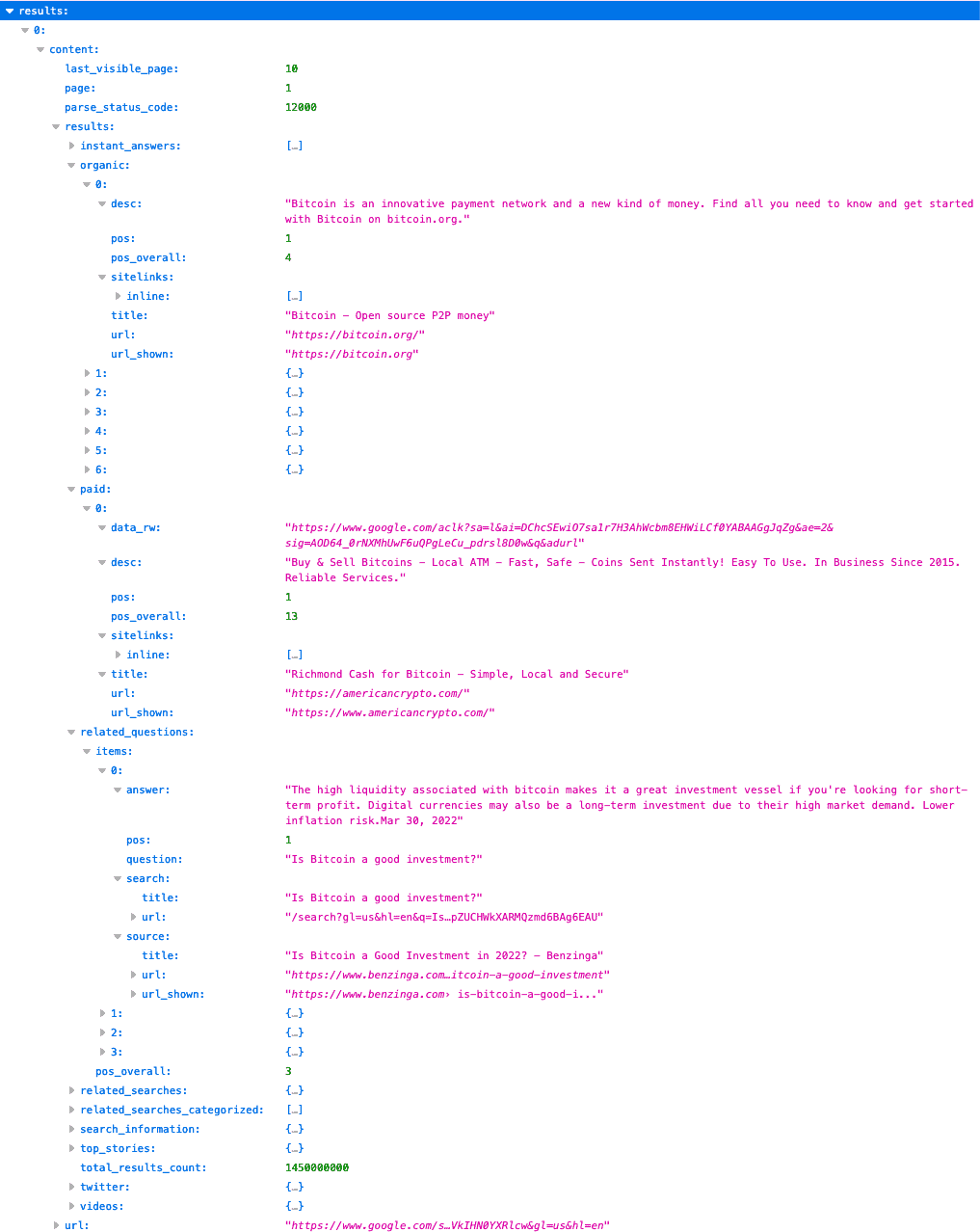

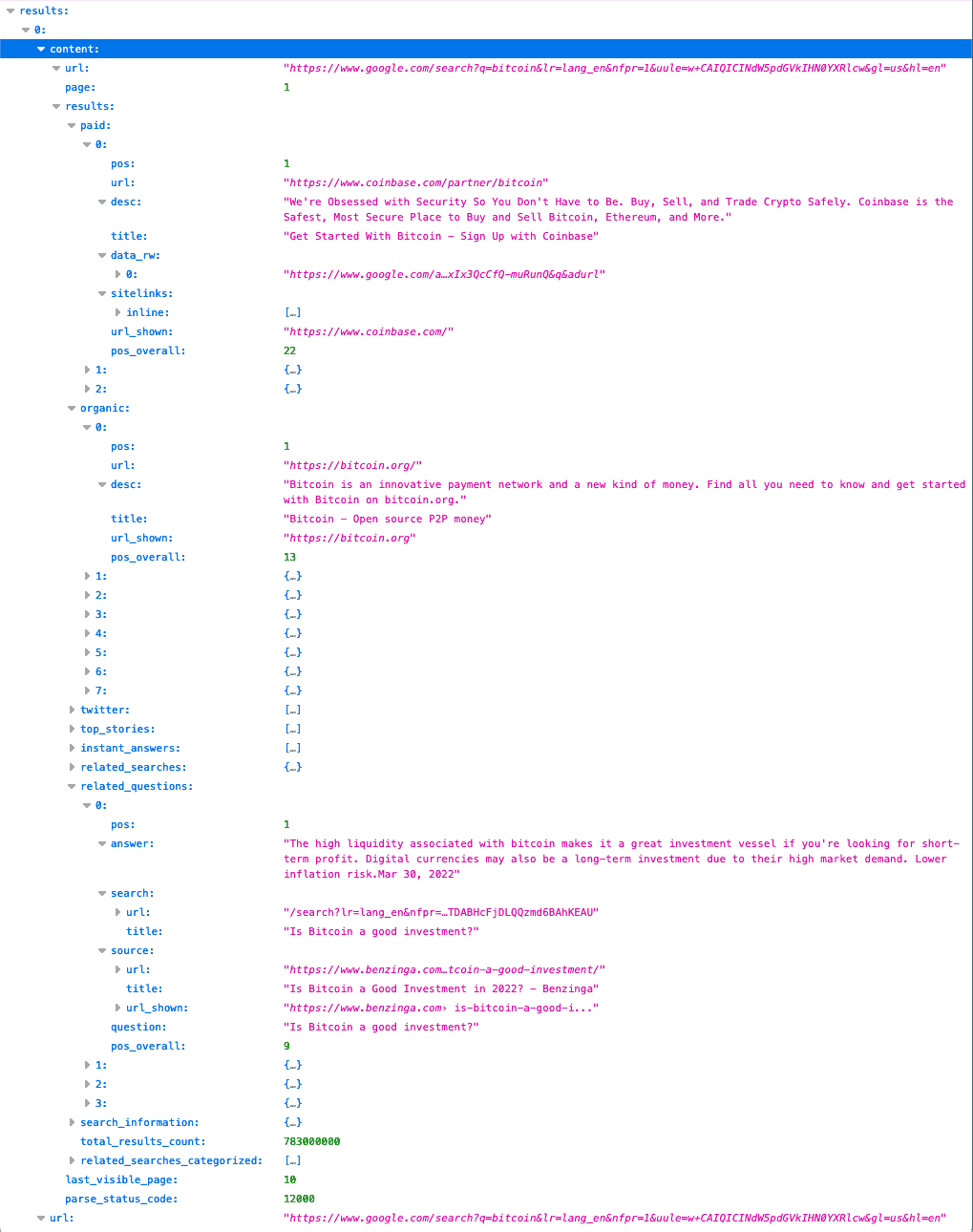

- We based our tests on Google Search and chose the APIs accordingly.

- Such services charge for successfully retrieved data; at $100, they cost around $3.18 per 1,000 requests. Blazing SEO is the most affordable option.

- Bright Data’s tool showed impressive performance: with an average response time of 3.92 seconds, it outpaced the competitors by two to four times.

- Three out of the four participants could parse most aspects of Google Search, two were able to function asynchronously, and only one had CSV support.

- Overall, Bright Data and Oxylabs have the best proxy-based APIs for scraping Google.

User Experience

- The majority of the providers offer self-service, and two thirds have implemented a wallet functionality to reduce needless transactions.

- Most have straightforward proxy setup procedures but skimp on data visualization. NetNut and Bright Data have implemented the most detailed usage graphs.

- Providers tend to restrict their account management APIs for regular users, limiting its accessibility to resellers.

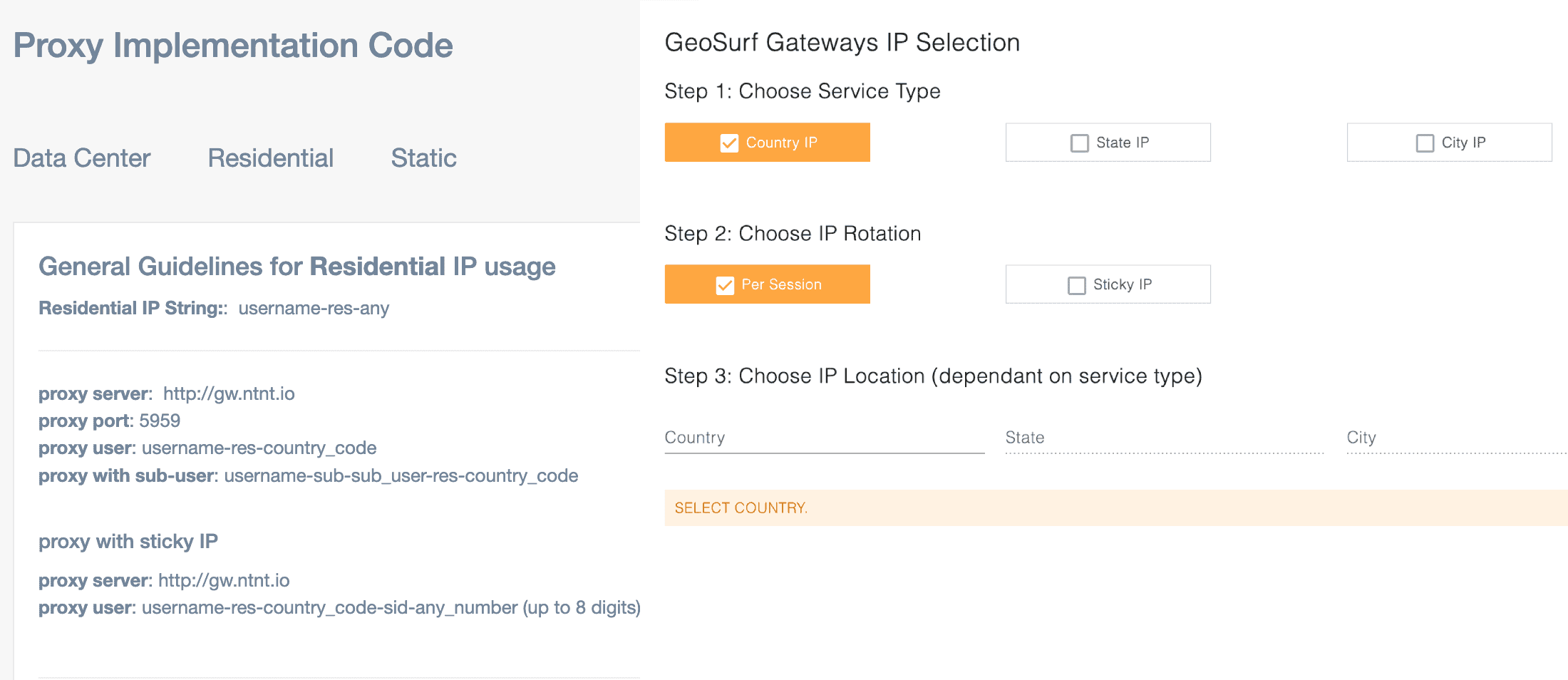

- Bright Data, Oxylabs, Smartproxy, and GeoSurf have the most detailed documentation about their services. It includes integration instructions, FAQs, code samples, and even white papers.

- Support by chat is much faster than over email, but only seven out of the 11 providers support it. The difference between the fastest and slowest average response exceeded 12 hours.

- Overall, we consider Smartproxy to have the best overall user experience. Bright Data left us with a good impression, too.

Classification of Proxy Servers

A proxy generally means a substitute. It’s a server standing between two devices on a network that captures and routes connection requests through itself.

This research concerns proxy servers that are forward and highly anonymous. Forward means that the proxy server reroutes connection requests leaving a device, as opposed to reverse proxies that intercept requests reaching a website. The latter are used for a whole different set of tasks like load balancing. Highly anonymous refers to servers that hide the IP address and location of the user, disclosing only the identifying information of the proxy server.

Such proxy servers are most frequently categorized by their origin. The four main types are datacenter, residential, ISP, and mobile proxies. Lately, it also makes increasing sense to include proxy-based APIs which build upon individual proxy networks.

Use Cases

From improving anonymity to collecting huge amounts of data, proxy servers have many uses. We don’t pretend to know all of them – especially all the black-hat schemes that still haunt the web. Nonetheless, we decided to list some of the main business applications, together with the proxy types we believe work well for them. As always, advice like this should be treated as guidelines and might not always hold water when faced with individual circumstances.

| Vertical | Use Case | Description | Preferred proxy type |

|---|---|---|---|

| E-Commerce | Price comparison | Businesses use proxies to monitor and compare prices – either for internal purposes or providing aggregation services | Datacenter or proxy-based API, then residential |

| Product demand and trends | Companies analyze data points like top products and customer reviews to make decisions | ||

| Keyword research | Amazon agencies and internal employees optimize products for ranking on e-commerce search engines | ||

| Account management | Businesses control multiple accounts on e-commerce platforms to avoid restrictions and diversify risk | Mobile or ISP, then residential |

| Vertical | Use Case | Description | Preferred proxy type |

|---|---|---|---|

| Reselling | Sneaker reselling | Sneakerheads buy limited edition shoes in bulk and resell them on secondary marketplaces | Residential or ISP |

| NFT reselling | Hustlers scan NFT marketplaces for rare items, buy them using automated bots | ||

| Retail reselling | Hustlers buy consoles, GPUs, trading cards, and other in-demand products in bulk and resell them on secondary marketplaces |

| Vertical | Use Case | Description | Preferred proxy type |

|---|---|---|---|

| Digital marketing | Search intelligence | SEO tools & agencies use proxies to research keywords, run technical audits, track local search rankings and link building efforts | Proxy-based API or residential |

| Ad testing | Marketing agencies scrape ads on search engines to provide insights about their effectiveness and use | ||

| Ad verification | Ad verification companies prevent ads from misplacement, check their redirection paths, and test how they appear in localized contexts | Residential or mobile |

| Vertical | Use Case | Description | Preferred proxy type |

|---|---|---|---|

| Social media | Social media intelligence | Marketers collect data about trending topics, search for influencers, and perform sentiment analyses | Mobile, then ISP or residential |

| Multiple account management | Social media agencies control multiple accounts on behalf of their clients, while marketers create accounts to increase reach |

| Vertical | Use Case | Description | Preferred proxy type |

|---|---|---|---|

| Travel and hospitality | Market intelligence | Companies monitor the popularity of hotels and flight locations, track their availability and pricing changes | Residential, then datacenter |

| Price comparison | Platforms aggregate the flight and hotel prices of leading websites |

| Vertical | Use Case | Description | Preferred proxy type |

|---|---|---|---|

| HR | Listing aggregation | Job search platforms aggregate listings from multiple websites to present them in one place | Proxy-based API, residential or datacenter |

| Background check | Companies check both employers and employees for their backgrounds, reviews, and other useful information | ||

| Web testing | Load testing | Developers emulate traffic to see how websites can withstand high loads and edge cases | Datacenter or residential |

| Localization testing | Developers and localization experts ensure that content is correctly displayed to visitors from relevant locations | Residential or mobile, then datacenter | |

| Data-as-a-service | Datasets | Companies or developers collect and sell data on a project basis (e. g. Zyte's data sets) | Varies by project |

| Brand protection | Intellectual property protection | Companies scan the web for unlicensed intellectual property use and counterfeits | Proxy-based API, datacenter or residential |

| Minimum advertised price monitoring | Companies scan the web for partners that violate minimum pricing agreements | ||

| Cybersecurity | Email protection | Companies check all the outgoing and incoming emails to detect potential fraudulent attempts | Datacenter |

Market Trends

Let’s review where the market headed in 2021. This year, we identified four noteworthy developments. The section also includes some first-hand proxy server usage trends. The latter are possible thanks to our partnership with Bright Data, which generously provided the information and allowed us to make it public. We’d like to thank the provider for that.

Proxy Server Usage Trends (in Partnership with Bright Data)

- Datacenter and residential addresses remain by far the most popular proxy types. Whether in the form of proxy networks or Web Unlocker, a proxy-based API, they take 95% of proxy usage. Despite the buzz, mobile and ISP proxies are still used for a narrow range of tasks, at least among Bright Data’s clientele.

- The proxy server market continues grow fast. The use of datacenter traffic increased by 60%, and residential proxies grew by 70% in 2021. It shows that more companies are finding value in collecting data and using it to make informed decisions.

- Proxy-based APIs are starting to play an increasingly important role. The signs were already there last year, but it seems that proxy-based APIs are now gaining real momentum:

- Web Unlocker increased its revenue by 60% by only running 10% more traffic. It shows that Bright Data and other providers are able to continuously optimize the tools through machine learning and basic trial-and-error.

- Search Engine Crawler, an API for scraping search engines, increased its traffic by 800%.

- Four major use cases constitute two thirds of all proxy use:

Explosion of Dongle-Based Mobile Proxy Services

Dongle-based mobile proxies are USB sticks with SIM cards inside them. With the help of special software (or a clever script), each stick turns into its own proxy server. Compared to peer-to-peer proxy networks, this arrangement gives more control over individual IPs, with longer uptime and on-demand rotation. And most importantly – it removes traffic limits, thanks to unlimited plans offered by mobile carriers.

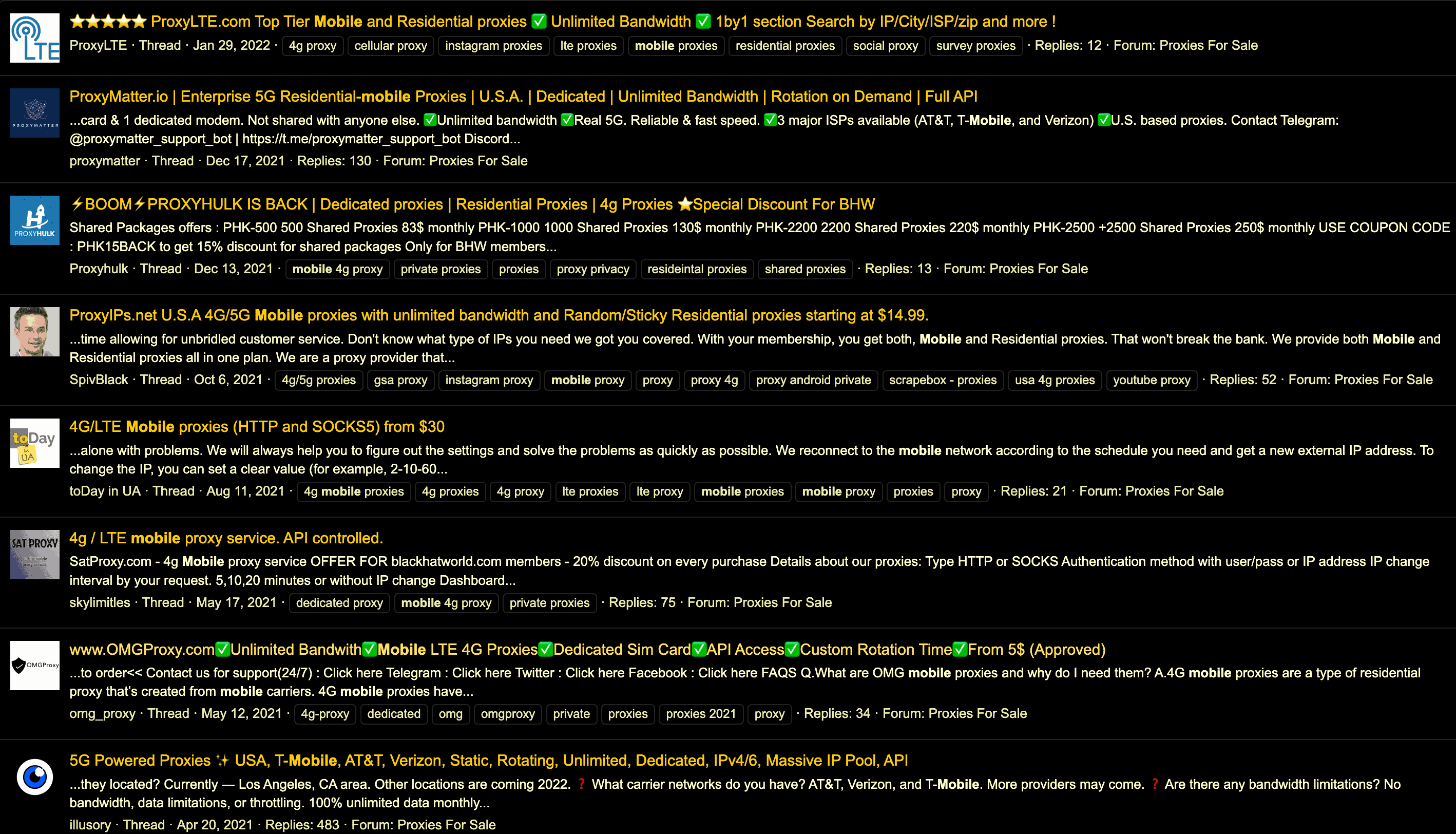

Dongle-based mobile proxies aren’t new – the oldest services date back to 2018. However, it wasn’t until 2021 that this type of service really exploded. A quick scroll through BlackHatWorld, a wildly popular online forum, shows nearly 20 new providers that entered the market in 2021.

This number is all the more staggering considering that few of these services resell proxies (at least we’re inclined to think so). The whole gist is that you can set up the mobile proxies at home; the process is well documented, and even one device can potentially cover hundreds of IPs over time. A company called Proxidize further simplifies things, offering a plug-and-play solution that doesn’t require coding skills. According to the website, it’s served over 1,000 clients since launch.

The demand is driven by multiple account managers that need stable high-quality IPs for social media and e-commerce platforms. Some of the providers we spoke with have turned their hustles into million dollar businesses. But at the same time, out of the 20 newcomers, 5 have already closed. The proxy market juggernauts aren’t too keen (or hurried) on introducing dongle-based proxies either, at least so far.

Hard Times for the Sneaker Scalping Business

The last few years were generous for sneaker scalpers: money good and morale high. Minor setbacks – such as Nike’s SNKRS app becoming realistically unbottable – were offset by plentiful bounties from Yeezy Supply and Footsites. Even Supreme didn’t take security seriously yet.

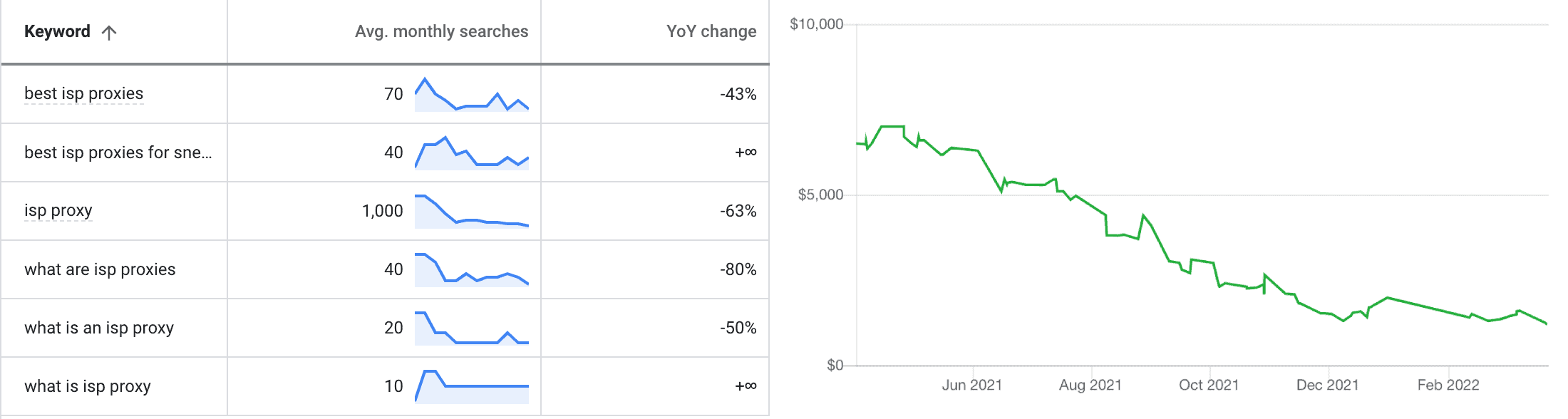

In the process, sneakerheads popularized the category of ISP proxies by adapting its strengths for the niche. At first, this proxy type emulated the business model of residential proxies: it sold access to a pool IPs limited by traffic. Botters introduced IP-based plans without traffic limits, which displaced increasingly ineffective datacenter proxies.

The high continued well into 2021, reaching its apex in late spring. But then it took on a downward course. Without prying into internal data of proxy providers, we have two sources to tell the story: bot prices and Google search demand. Both show a sharp decrease starting with mid-summer:

A Proxyware App for Everyone

Proxyware bandwidth sharing apps offer people to rent out their IP in exchange for money. This way, they effectively become proxies, bolstering the networks of residential and mobile proxy providers. For each gigabyte of data transferred via their network, users earn up to a dollar (usually $.10-30), which they can spend on anything they desire, such as paying the Netflix bill.

Proxyware apps are a sought-after way to source IPs. While not without blemishes, this method ensures both explicit consent and compensation for the user. Proxy providers can then brag about their ethicality, which is becoming a serious selling point. They also decrease reliance on shady in-app SDKs that tend to get purged from mobile stores often enough to cause a headache.

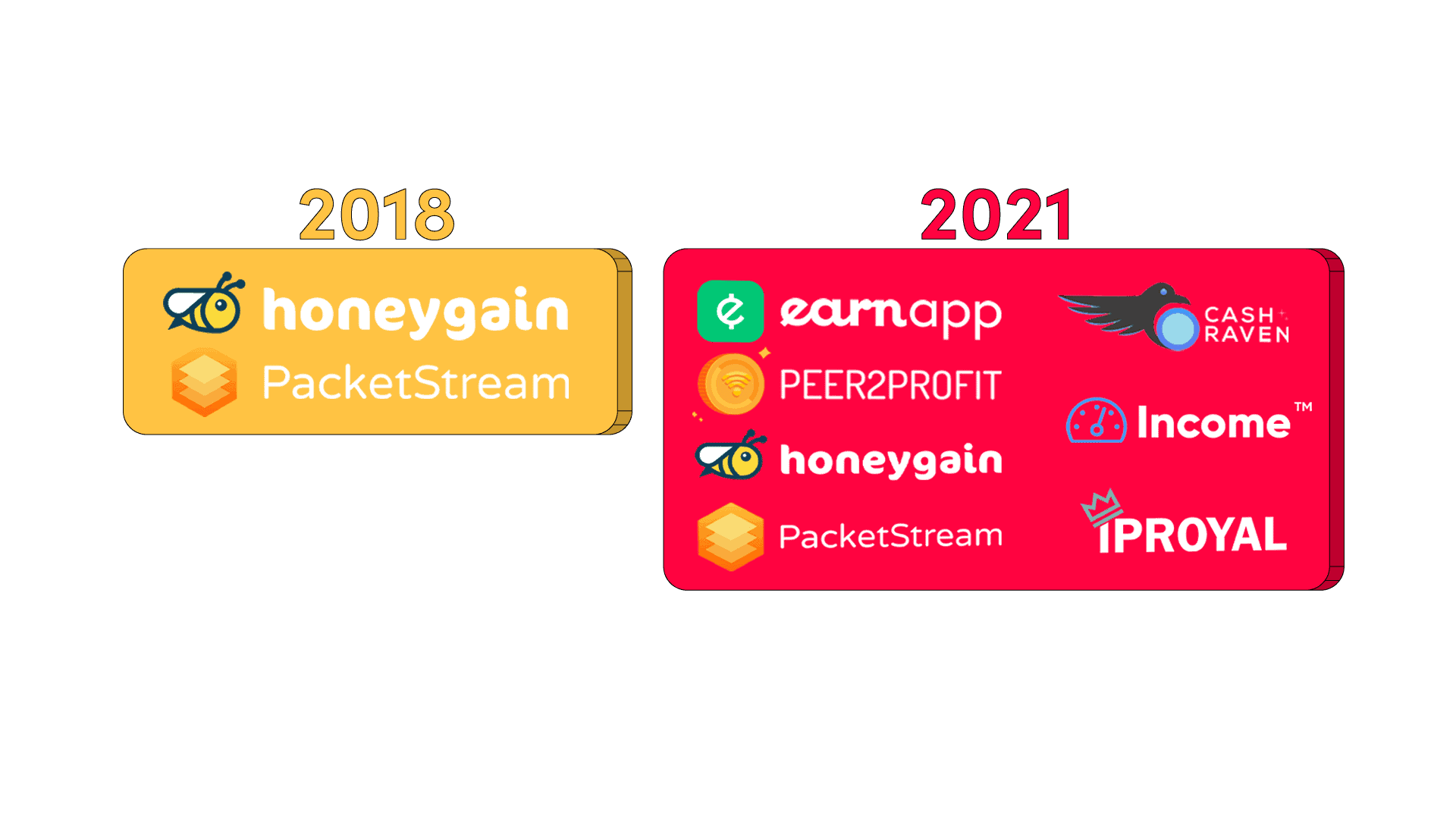

Before 2021, the market had two major proxyware apps: Honeygain and PacketStream. At the end of the year, the number had more than tripled, with at least seven apps now on the market. Most of them are operated by major proxy providers wishing to jump onto the passive income train. This means more competition, more IP overlap (people have several apps installed at once), and hopefully, better conditions for the sharers.

The Legal Battles Continue

Participants

This year’s research includes 11 proxy services. Together they take the lion’s share of the proxy server market – especially in the areas of residential proxies and proxy-based web scraping APIs.

Many of these companies have appeared in our previous researches, so it’s possible to track their progress over time. Some, like RSocks and Shifter, rejoin after a year’s pause. Others – more specifically, Blazing SEO and IPRoyal – participate for the first time.

A powerhouse of datacenter proxies trying to become a one-stop-shop for any data collection professional. Since 2021, Blazing SEO offers all major proxy types, along with a general-purpose web scraper. Though it can’t stand toe-to-toe with the largest players in all areas yet, Blazing SEO is on the right track.

- Country: United States

- Founded: 2016

- Proxy networks: datacenter, residential, ISP, mobile

- Tools: SEO, e-commerce, and general-purpose web scraper

Backed by equity fund EMK Capital, Bright Data is a juggernaut that offers all-inclusive proxy services anywhere in the world. The provider targets business customers and Fortune 500 companies, positions itself as an ethical proxy service, and has built a strong ecosystem of data collection tools around its proxy networks. Bright Data fights as fiercely in court as it does in the market.

- Country: Israel

- Founded: 2014

- Proxy networks: datacenter, residential, ISP, mobile

- Tools: proxy manager, browser extension for proxy management & web scraping, search engine scraper, general-purpose scraping API, no-code data collector, data sets

A subsidiary of ad intelligence company BiScience, GeoSurf is a market veteran known for its premium residential proxy IPs and a VPN service. Despite being small, the provider’s reach covers over 1,000 locations. This has historically made GeoSurf a go-to place for ad intelligence and localization companies. Lately, it’s been looking stagnant, probably due to the drawn-out dispute with Bright Data.

- Country: Israel

- Founded: 2009

- Proxy networks: residential, ISP

- Tools: browser extension

A new company that has quickly made a name for itself with affordable services and a bandwidth-sharing app. In this, IPRoyal resembles PacketStream. But it offers more versatility and is much more actively involved in promoting the project, especially among niche communities (such as sneakerheads). For now, IPRoyal focuses on the lower end of the market.

- Country: Lithuania

- Founded: 2021

- Proxy networks: datacenter, residential, ISP, mobile

- Tools: browser extension, Google scraper

A subsidiary of Safe-T group and one more company from Israel. Originally the major provider of ISP proxies, the company now sells three rotating proxy networks to cover more ground. Despite offering affordable plans, NetNut primarily targets enterprises with data collection needs and proxy resellers. It also actively participates in the sneakerhead niche via its daughter company Chi Proxies.

- Country: Israel

- Founded: 2018

- Proxy networks: datacenter, residential, ISP

- Tools: browser extension, scraping API

The contender for the first place, Oxylabs controls both the largest datacenter and residential IP networks today. Like Bright Data, it offers an arsenal of features and tools for extracting data from the web, some based on cutting edge AI & ML technology. Oxylabs targets mid-to-large businesses, wooing them with SLAs, insurance, and personalized support.

- Country: Lithuania

- Founded: 2015

- Proxy networks: datacenter, residential, ISP, mobile

- Tools: browser & Android extension, proxy-based API, search engine, e-commerce, and general-purpose web scrapers

One of the first bandwidth-sharing marketplaces, PacketStream has been a strong budget option and reseller’s choice for several years now. However, it’s experienced few changes since 2019, which has allowed competitors to mimic the provider’s business model and reduce the price gap. Still, PacketStream’s value proposition remains strong enough to continue drawing in new clients.

- Country: United States

- Founded: 2018

- Proxy networks: residential

- Tools: –

A reseller, RSocks mixes and matches the proxy networks of others to create new value propositions for customers. It’s known for large, periodically updating proxy lists without traffic limits, dozens of pricing plans that focus on specific requirements, and a questionable sense of business ethics. Overall, RSocks is a respectable force among individual and small business clients.

- Country: Russia

- Founded: 2016

- Proxy networks: datacenter, residential, mobile

- Tools: proxy checker

The third major player beside Bright Data and Oxylabs, Smartproxy found its fame by offering a highly balanced rotating proxy service. Though considered a premium provider, Smartproxy emphasizes value and ease of use: it offers top-shelf quality while cutting fringe features to reduce the price. Recently, the company has been building tools to capture more value from its proxy networks.

- Country: International

- Founded: 2018

- Proxy networks: datacenter, residential

- Tools: proxy generator, browser extensions for proxy management & web scraping, search engine scraper, antidetect browser

A long-standing proxy provider, Shifter has built its clientele by solving the major limitation of residential IP networks – traffic limits, basing the pricing on ports instead. It targets business clients and resellers that can afford paying hundreds to thousands of dollars for increasingly unlimited access. Before the rebrand in 2020, Shifter’s previous name Microleaves was associated with intrusive online adware.

- Country: United Kingdom

- Founded: 2015

- Proxy networks: datacenter, residential

- Tools: –

Another relative newcomer, SOAX sells residential and mobile IPs to small & medium businesses. It successfully debuted in our research last year and seems to have gained a comfortable foothold in the market since. SOAX differentiates itself by pairing a robust proxy network with premium features (like ASN targeting) out of the box.

- Country: UK

- Founded: 2019

- Proxy networks: residential, mobile

- Tools: –

Methodology

We first reached out to providers asking if they wanted to take part. Out of the 11 participants, 10 voluntarily gave access to their services; PacketStream failed to respond, so we used the funds we had on the platform from previous tests.

To evaluate the providers, we applied both automated performance tests and manual analysis.

The testing took place during February and March of 2022.

Services Tested

This year’s research has a bigger scope compared to previous editions. It includes not only residential proxies but other services as well: dedicated datacenter, pool-based mobile proxies, and proxy-based APIs.

| Participants | Dedicated Datacenter | Residential | Mobile | Proxy-Based API |

|---|---|---|---|---|

| Blazing SEO | ✅ | ✅ | ✅ | ✅ |

| Bright Data | ✅ | ✅ | ✅ | ✅ |

| GeoSurf | ✅ | |||

| IPRoyal | ✅ | ✅ | ||

| NetNut | ✅ | |||

| Oxylabs | ✅ | ✅ | ✅ | ✅ |

| PacketStream | ✅ | |||

| RSocks | ✅ | |||

| Smartproxy | ✅ | ✅ | ✅ | |

| Shifter | ✅ | |||

| SOAX | ✅ | ✅ |

Testing Methodology

Evaluation Methodology

To evaluate the providers, we distinguished categories that we deemed relevant for that proxy type, such as proxy pool, performance, or price. We then identified aspects within those categories – for example, number of unique IPs under pool size – and weighted them. Finally, we gave providers in each category a score from 0 to 5 based on their results.

The purpose of the evaluation methodology is to allow a quick comparison of the providers. We believe that the scores accomplish this task well. Still, some find the evaluation opinionated or the criteria too rigid (a pitfall of most standardized comparisons). In such cases, there’s always hard data to fall back on.

General Evaluation

Here’s our evaluation of the participants based on the different services they provide. For your convenience, we’ve divided them into categories by price.

Hover on provider names to highlight, click to filter.

Hover on provider names to highlight, click to filter.

Hover on provider names to highlight, click to filter.

Hover on provider names to highlight, click to filter.

Dedicated Datacenter Proxies

Approachable price, reliable performance, and availability typically make datacenter proxies the first choice for proxy server users. They can be shared among several people, and it even makes sense to talk about rotating datacenter proxy pools. But in general, businesses prefer addresses dedicated to one user, as it ensures full control over the IPs.

It’s both easy and hard to test datacenter proxies. Easy because you get a finite number of addresses – they either work with websites or don’t. Hard because the same set of IPs may not perform the same on different websites, and some providers, especially premium ones, hand-pick addresses for particular uses.

Still, that didn’t stop us from trying out dedicated datacenter proxy services. You’ll find this section divided into three parts (click on them to expand):

Proxy Performance

Dedicated datacenter proxies have the best raw specifications out of all proxy types: fastest connection, highest stability, and best performance under load per IP address. At the same time, they struggle the hardest against websites that monitor IP reputation. Using one won’t necessarily get you blocked; but the threshold will be much lower and further modified by factors like ASN (company that owns the IP) and usage history.

We modeled our benchmarks around three questions:

- What’s the success rate with popular targets?

- How fast are the proxies to establish a connection?

- Does an IP database identify them as proxies?

- Proxies: 100 US IPs

- Requests: ~1,500 each target

- Targets: AliExpress, Amazon, Booking, Craigslist, Homedepot, Indeed, Walmart

- Proxies: 100 US IPs

- Requests: ~1,500 each

- Targets: AliExpress, Amazon, Booking, Craigslist, Homedepot, Indeed, Walmart

AliExpress

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 100.00% | 0.00% | 0.00% | 1.59 |

| Bright Data | 99.87% | 0.13% | 0.00% | 1.94 |

| IPRoyal | 100.00% | 0.00% | 0.00% | 0.99 |

| Oxylabs | 100.00% | 0.00% | 0.00% | 1.40 |

| Smartproxy | 99.30% | 0.07% | 0.00% | 1.77 |

Amazon

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 93.86% | 1.28% | 4.86% | 2.58 |

| Bright Data | 70.36% | 2.08% | 27.55% | 2.86 |

| IPRoyal | 77.14% | 0.20% | 22.66% | 2.20 |

| Oxylabs | 95.43% | 2.52% | 2.05% | 2.61 |

| Smartproxy | 95.85% | 0.80% | 3.35% | 2.62 |

Craigslist

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 100.00% | 0.00% | 0.00% | 1.66 |

| Bright Data | 57.26% | 0.20% | 42.54% | 2.35 |

| IPRoyal | 99.93% | 0.07% | 0.00% | 1.12 |

| Oxylabs | 99.94% | 0.06% | 0.00% | 1.16 |

| Smartproxy | 73.12% | 0.00% | 26.88% | 1.56 |

Home Depot

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 99.94% | 0.06% | 0.00% | 1.15 |

| Bright Data | 84.89% | 0.00% | 15.11% | 1.56 |

| IPRoyal | 98.99% | 0.00% | 1.01% | 0.85 |

| Oxylabs | 100.00% | 0.00% | 0.00% | 0.99 |

| Smartproxy | 98.93% | 0.00% | 1.07% | 1.09 |

Walmart

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 99.41% | 0.46% | 0.13% | 1.35 |

| Bright Data | 99.87% | 0.13% | 0.00% | 1.94 |

| IPRoyal | 99.94% | 0.06% | 0.00% | 1.07 |

| Oxylabs | 99.68% | 0.32% | 0.00% | 1.03 |

| Smartproxy | 99.87% | 0.07% | 0.00% | 1.30 |

Booking

| Success Rate | Errors | Blocks | Response Time | |

|---|---|---|---|---|

| Blazing SEO | 100.00% | 0.00% | 0.00% | 2.61 |

| Bright Data | 99.87% | 0.13% | 0.00% | 3.68 |

| IPRoyal | 100.00% | 0.00% | 0.00% | 2.41 |

| Oxylabs | 100.00% | 0.00% | 0.00% | 2.27 |

| Smartproxy | 100.00% | 0.00% | 0.00% | 2.70 |

Indeed

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 100.00% | 0.00% | 0.00% | 1.33 |

| Bright Data | 63.33% | 36.67% | 0.00% | 2.09 |

| IPRoyal | 80.49% | 19.51% | 0.00% | 1.10 |

| Oxylabs | 100.00% | 0.00% | 0.00% | 1.18 |

| Smartproxy | 76.28% | 23.72% | 0.00% | 1.44 |

| Provider | Avg. Download Speed (Mbps) |

|---|---|

| Blazing SEO | 112.29 |

| Bright Data | 31.57 |

| IPRoyal | 121.46 |

| Oxylabs | 127.27 |

| Smartproxy | 115.57 |

- Proxies: 100 US IPs

- Database: ipapi.com

| wdt_ID | Provider | Hosting | Proxy |

|---|---|---|---|

| 1 | Blazing SEO | 0.00 | 45.00 |

| 2 | Bright Data | 65.00 | 22.00 |

| 3 | IPRoyal | 0.00 | 100.00 |

| 4 | Oxylabs | 100.00 | 0.00 |

| 5 | Smartproxy | 51.00 | 24.00 |

Blazing SEO and Oxylabs aced the tests, others encountered some issues. Our assortment of websites revolved around e-commerce, which is a popular use case for datacenter IPs. Overall, the providers gave us good proxies. Others found targets like Amazon and Craigslist a challenge: for example, Smartproxy had 27% and Bright Data 42% of their IPs blocked on Craigslist.

Otherwise, the proxies had very few connection errors. Indeed.com was an exception, but that’s probably the website’s way of blocking unwanted addresses.

Datacenter proxies are fast, but not equally so. Overall, it took the datacenter proxies an average of 1.75 seconds to reach their destination. This is significantly faster than residential or mobile IPs. IPRoyal’s connection proved to be the fastest, and Bright Data’s slowest. In some cases (see: Craigslist) the latter connected half as fast. Maybe the server hosting the IPs was under more load, or simply slower.

Dedicated datacenter proxies easily reach 100 Mbps speeds. At least four out of the five providers did. Bright Data was several times slower, but its proxies should be fine for streaming video or downloading large files.

Proxy detection status had little impact on the results (or we used a wrong IP database). We ran each proxy through the ipapi database to check if they had been identified as hosting or proxy IPs. However, even when they were, that didn’t seem to have an impact on the results: Blazing SEO did very well despite a half of its IPs appearing as proxies. So, either the databases that our target websites use had different data (which is likely), or the targets decided not to block IPs based on this data point alone.

Features

Like all proxy types, dedicated datacenter proxies are about location coverage, protocols, and authentication options. But they also involve specific features that are less relevant for residential or mobile IPs.

For one, dedicated datacenter proxies come in finite static lists. Clients don’t expect them to rotate, but they do ask for the ability to refresh blocked addresses. Second, these proxies are marketed as unlimited: carrying no limitations on threads, traffic, and domains (aside from blacklisted websites).

| Participants | Countries | Country selection | City selection |

|---|---|---|---|

| Blazing SEO | 29 | One per plan | Assigned randomly |

| Bright Data | 95 | Multiple per plan | ✅ |

| IPRoyal | 6 | One per plan | ✅ (only Chicago/LA) |

| Oxylabs | 88 | As agreed with provider | ✅ |

| Smartproxy | 1 (US) | One per plan |

| Participants | HTTP(S) | SOCKS5 |

|---|---|---|

| Blazing SEO | ✅ | ✅ |

| Bright Data | ✅ | ✅ |

| IPRoyal | ✅ | ✅ |

| Oxylabs | ✅ | ✅ |

| Smartproxy | ✅ |

| Participants | Credentials | IP whitelisting |

|---|---|---|

| Blazing SEO | ✅ | ✅ |

| Bright Data | ✅ | ✅ |

| IPRoyal | ✅ | ✅ |

| Oxylabs | ✅ | ✅ |

| Smartproxy | ✅ | ✅ |

| Participants | IP replacement |

|---|---|

| Blazing SEO | Free monthly + individual IPs |

| Bright Data | Paid |

| IPRoyal | Free monthly |

| Oxylabs | 20% free per quarter, then paid |

| Smartproxy | Free monthly |

| Participants | Domains | Threads | Traffic |

|---|---|---|---|

| Blazing SEO | Unlimited | Unlimited | Unlimited |

| Bright Data | One free / more or unlimited for extra fee | Unlimited | Limited / unlimited for extra fee |

| IPRoyal | Unlimited | Unlimited | Unlimited |

| Oxylabs | Unlimited | Unlimited | Unlimited |

| Smartproxy | Unlimited | Unlimited | Unlimited |

For location variety go with Bright Data or Oxylabs. Both providers allow selecting the most countries, several locations per plan, and even particular cities. Bright Data’s system is the most comfortable, as it supports self-service; Oxylabs requires talking with an account manager. Blazing SEO allows choosing cities in the dashboard if the location supports it.

Getting SOCKS5 proxies won’t be a problem. Four out of the five participants offer the protocol as an option. It works great for datacenter addresses, as they have high throughput and no traffic limits. Smartproxy promises to introduce the feature soon™.

Premium providers are stingy about replacing blocked IPs. Bright Data charges for each replacement, while Oxylabs has a threshold how many IPs clients can burn. IPRoyal and Smartproxy, both of which target smaller clients, can replace the whole proxy list monthly, no questions asked. Blazing SEO is highly flexible in that you can change individual IPs you don’t like.

Most services are truly unlimited – Bright Data’s can be if you shell out the cash. Four out of the five providers deliver impose no limits on traffic, threads, or domains clients can access. Bright Data does, but it also has an option to remove them. As we’ll see, limitations make a part of the provider’s business model.

Price

Datacenter proxy services are usually straightforward about pricing: buy a set number of IPs, pay per unit, use them to your heart’s content. But that’s not always the case. One provider we’ve tried allows customizing nearly everything, from traffic to threads, refreshes, and even connection quality. There’s a lot of room for variations, even if the market chooses not to apply them.

Let’s have a look at what strategies the participants choose and how they position themselves.

| Participants | Model | Duration | Upsells | Location Pricing |

|---|---|---|---|---|

| Blazing SEO | Pay per IP | Monthly, yearly | More IP replacements | Non-US IPs cost up to 75% more |

| Bright Data | Monthly, yearly | More domains, more traffic, IP replacements, city targeting | All locales cost the same | |

| IPRoyal | Monthly | All locales cost the same | ||

| Oxylabs | Monthly, yearly | More IP replacements | Non-US IPs cost up to 66% more | |

| Smartproxy | Monthly, yearly |

| Participants | 10 IPs | 50 IPs | 100 IPs | 250 IPs | 1,000 IPs |

|---|---|---|---|---|---|

| Blazing SEO | $2/IP | $2/IP | $1.7/IP | $1.7/IP | $1.5/IP |

| Bright Data (1 domain, 5 GB/IP) | $1.5/IP | $1.5/IP | $1.5/IP | $1.2/IP | $1/IP |

| Bright Data (all domains, unlimited traffic) | $3.8/IP | $3.8/IP | $3.24/IP | $3.2/IP | $2.55/IP |

| IPRoyal | $1.5/IP | $1.4/IP | $1.3/IP | ||

| Oxylabs | $1.8/IP | $1.5/IP | |||

| Smartproxy | $1.46/IP | $1.35/IP | $1.3/IP | $1.2/IP | |

| Average | $2.2/IP | $2.03/IP | $1.82/IP | $1.85/IP | $1.56/IP |

| Provider | Trial | Refund | Both |

|---|---|---|---|

| Blazing SEO | ✅ | ||

| Bright Data | ✅ | ||

| IPRoyal | |||

| Oxylabs | ✅ | ||

| Smartproxy | ✅ |

All participants have straightforward pricing models – except for Bright Data. The company’s pricing structure is as much customizable as it’s complex. Clients can choose the number of domains they want to access, enter their traffic needs, and enable the ability to target particular cities. Naturally. each feature bloats the price, to the point where a barebones configuration costs 2-3 times less than the full one.

Some providers charge more for non-US proxies. Blazing SEO and Oxylabs are a case in point – their proxies outside of the US are 50% or more expensive, based on the location. The others don’t follow this practice.

Each participants positions itself differently:

- IPRoyal goes cheap and targets smaller clients – while you can buy more than 100 IPs in the dashboard, the price per IP remains the same.

- Smartproxy also targets bargain hunters; but its plans start higher up and continue scaling to thousands of IPs.

- Blazing SEO tries to capture all potential customers with broad plans and mid-level prices that scale rather slowly.

- Bright Data aims for a wide range of clients as well but does so through customizability. It ends up favoring better-paying users that can better rates by committing to spend set amounts.

- Oxylabs makes itself approachable to premium clients only with plans that start from $180.

Overall, IPRoyal and Smartproxy can be treated as affordable providers, Blazing SEO as a mid-level provider, and Oxylabs as a premium one. It’s hard to position Bright Data; but, giving its proxies the same features as the competitors makes it the most expensive option (at least when buying US IPs).

Here’s our evaluation of the providers based on the aspects covered:

All in all, IPRoyal and Smartproxy are value-oriented providers. They compensate for limited features – mostly in terms of location targeting – with lower prices. This makes the providers a bargain for clients that are content with the limitations, and a less suitable choice for those that need more. Smartproxy seems to scale better of the two.

Blazing SEO’s graph is highly balanced, and we believe that to be the case. The provider offers a respectable number of locations and features, prices that aren’t the lowest but cover the whole range, and great performance.

Bright Data and Oxylabs steer toward the premium end of the scale. Both have an impressive number of features, and both cost above average. Overall, Bright Data provides more customization options, which come at a price. It’s just a little unnerving that the proxies we received were outperformed even by the entry-level providers. Oxylabs performed very well, as expected from a premium service.

Residential Proxies

Residential proxies are a second popular option for proxy servers. They’re used when datacenter IPs can’t access targets due to IP reputation checks, or when granular location targeting is needed. With the web becoming more gated and geographically tailored, this covers more use cases with each passing year.

Our residential proxy evaluation is perhaps the most complete out of the four services. First, because it includes all the largest providers (truth be told, our selection procedure was designed around this proxy type); and second, because we’ve had several years to refine the methodology.

You’ll find this section divided into four parts (click on them to expand):

Proxy Pool

Residential IP pools are in constant flux – their availability changes hourly, as proxy peers connect and disconnect their devices from the network. It’s very hard to capture such a pool’s size over time, so the numbers that providers advertise are monthly averages at best. They’re often inflated for marketing purposes and always change from one month to the other.

At the same time, a residential proxy network’s size is the most important criterion in choosing a service. No matter how good the performance is or how many features they can get, clients will always prioritize having enough unique IPs in locations they care about.

Our residential proxy pools tests measure:

- How many unique IPs the providers have globally.

- How many unique IPs they control in seven high-value locations.

- What percentage of those IPs is really residential.

| Provider | Monthly IPs |

|---|---|

| Blazing SEO | 10,000,000 |

| Bright Data | 72,000,000 |

| GeoSurf | 3,700,000 |

| IPRoyal | 2,000,000 |

| NetNut | 20,000,000 |

| Oxylabs | 100,000,000 |

| PacketStream | 7,000,000 |

| RSocks | 8,000,000 |

| Smartproxy | 40,000,000 |

| Shifter | 30,000,000 |

| SOAX | 5,000,000 |

- Locations: All

- Requests: 1,000,000 over 18 days

- Locations: US, UK, Germany, France, Russia, Canada, Australia

- Requests: 300,000 each over 14 days; CA, AU – 50,000 each over 7 days

Hover to see numbers, click on country labels to filter.

IPs that the IP2Location database treats as belonging to a landline and/or mobile internet service provider. If not, the IP can be commercial or educational, but most often datacenter.

| Provider | Global | US | UK | DE | FR | RU | CA | AU |

|---|---|---|---|---|---|---|---|---|

| Blazing SEO | 97.86% | 93.36% | 97.31% | 96.99% | 94.53% | 98.66% | 100.00% | 81.82% |

| Bright Data | 97.83% | 99.21% | 98.80% | 98.30% | 95.12% | 97.76% | 98.78% | 98.78% |

| GeoSurf | 93.53% | 78.78% | 85.89% | 93.06% | 87.24% | 92.88% | 88.66% | 92.59% |

| IPRoyal | 95.98% | 89.34% | 96.42% | 91.13% | 95.86% | 98.33% | 99.15% | 96.35% |

| NetNut | 86.19% | 67.26% | 96.78% | 92.87% | 93.70% | 93.62% | 97.43% | 91.38% |

| Oxylabs | 95.81% | 94.23% | 95.47% | 95.53% | 95.92% | 96.78% | 95.34% | 97.55% |

| PacketStream | 95.85% | 89.37% | 96.61% | 91.24% | 95.01% | 98.28% | 99.23% | 96.66% |

| RSocks | 91.53% | 96.93% | 96.03% | 97.29% | 97.75% | 93.32% | 95.02% | 98.11% |

| Smartproxy | 95.34% | 95.13% | 97.31% | 95.33% | 96.43% | 96.27% | 97.02% | 97.84% |

| Shifter | 94.98% | 81.97% | 81.52% | |||||

| SOAX | 91.78% | 95.54% | 94.44% | 94.76% | 93.40% | 92.60% | 93.39% | 94.77% |

Some advertised proxy networks are 20 and more times larger compared to smaller competitors. With 100 million monthly IPs, Oxylabs controls the largest residential proxy pool in theory. Compared to GeoSurf’s 3.5 million IPs, the difference is gigantic.

Providers with the largest IP pools can back their claims; the others – not always. In our tests, Bright Data, Oxylabs, and Smartproxy returned 2-20 times more unique IPs than the competition. NetNut also performed well. However, providers like PacketStream and RSocks could barely beat GeoSurf despite advertising several times more IPs.

Shifter and especially Blazing SEO were the furthest from their claims. We can understand Blazing SEO, as it’s a barely out-of-beta service. Shifter, however, underperformed.

A large proxy pool doesn’t guarantee IPs in high-value locations. Not always, at least. Providers with the most IPs overall also performed well with specific country pools. PacketStream, RSocks, and SOAX, on the other hand, had a disproportionate number of Russian addresses and few US or European proxies. GeoSurf overperformed in comparison.

Furthermore, PacketStream and IPRoyal had nearly identical results. We don’t want to jump to conclusions, but the evidence strongly suggests reselling.

Unfortunately, the number of ports we received from Shifter simply wasn’t enough to complete these tests on time.

Most providers really offer residential addresses – but some tend to cheat. Proxies in the US were the worst offenders. Over 30% of NetNut’s IPs were classified as datacenter; the provider likely added its ISP proxies into the pool. GeoSurf surprised with over 15% datacenter (and 5% educational) IPs, which is uncharacteristic for this provider and something we didn’t expect. Shifter also had a fair share of datacenter proxies mixed in – be it the US or UK.

Proxy Performance

The residential proxy performance benchmarks answer four questions:

- How reliably the proxy infrastructure can connect to a target (success rate).

- How long it takes to establish a connection (response time).

- How well the infrastructure handles load (stress test).

- How these results translate to popular targets like Google and Amazon.

The first two were made together with the proxy pool tests; their scale makes the benchmarks highly dependable and resistant to outliers. However, the target tests shouldn’t be taken for granted: we made much fewer connection requests, and the results depend on the web scraping setup.

- Target: Cloudflare

- Locations: Global

- Requests: 1,000,000

Year over Year

- Target: Cloudflare

- Locations: Global

- Requests: 1,000,000

Year over Year

- Target: Cloudflare

- Locations: US, UK, DE, FR, RU, CA, AU

- Requests: 300,000 each

| Provider | US | UK | DE | FR | RU | CA | AU |

|---|---|---|---|---|---|---|---|

| Blazing SEO | 1.65 | 1.77 | 1.64 | 2.17 | 2.14 | 1.20 | 2.11 |

| Bright Data | 1.30 | 0.72 | 0.74 | 0.73 | 0.99 | 1.45 | 1.72 |

| GeoSurf | 2.25 | 2.35 | 2.18 | 2.47 | 2.70 | 2.89 | 2.89 |

| IPRoyal | 3.11 | 1.55 | 1.70 | 1.85 | 1.35 | 1.32 | 2.50 |

| NetNut | 0.86 | 1.05 | 1.02 | 1.35 | 2.09 | 1.39 | 2.08 |

| Oxylabs | 1.09 | 0.50 | 0.50 | 0.60 | 1.25 | 0.93 | 1.70 |

| PacketStream | 3.08 | 1.59 | 1.75 | 1.74 | 1.36 | 1.39 | 2.63 |

| RSocks | 2.18 | 1.73 | 2.85 | 2.36 | 1.36 | 1.51 | 2.88 |

| Smartproxy | 1.14 | 0.60 | 0.61 | 0.66 | 1.33 | 1.67 | 1.67 |

| Shifter | 1.37 | 0.83 | |||||

| SOAX | 1.92 | 1.68 | 2.79 | 2.16 | 1.40 | 1.56 | 2.69 |

- Requests per second: 300

- Duration: 5 minutes

- Total requests: 150,000 each

10 Out of 11 providers are able to achieve over 90% success rate. This shows that nowadays proxy companies have robust infrastructure. Only RSocks dropped the ball, which is strange considering that we recently tested the same pool and got nearly a 99% success rate. But the scope was smaller (250k vs 1 million connection requests), and maybe things have changed since then.

This year, it’s hard to single out a leader, as Blazing SEO, Bright Data, Oxylabs, Smartproxy, and SOAX all linger around the 99% mark.

Response time depends on IP location and differs up to 3 times between providers. The average response time across the board was around 1.9 seconds. Oxylabs and Bright Data are the obvious speed kings: the former was up to three times faster compared to IPRoyal and PacketStream. Smartproxy and NetNut are close behind. The others gravitate around 2-2.5 seconds.

The response time for individual countries suggests where the providers have their load balancing servers. For example, NetNut was very speedy in the US but not so much in Russia. RSocks and SOAX – the other way around. Bright Data and Oxylabs were amazingly fast in Europe, especially Oxylabs with a 0.5 s response time (!) in the UK. However, it’s hard to explain PacketStream’s sluggishness in the US, as it’s an America-based provider.

NetNut’s and SOAX’s results have improved over year, PacketStream’s declined. Compared to the year before, SOAX has made the biggest improvement in response time and NetNut in success rate. Team SOAX told us they were running constant routing experiments, but we didn’t expect the change to be this notable (3.69 -> 2.34 seconds). For some reason, PacketStream’s success rate has markedly declined – maybe because of high network load.

Most providers can handle running hundreds of requests per second. This year, our stress test didn’t tell much: it failed to make a dent in all but one proxy network. PacketStream’s success rate suffered, but that might have coincided with outside causes. That said, the test did have an impact on response time. Most providers saw it increase, but GeoSurf and SOAX performed even faster than they had otherwise.

- Location: US

- Targets: AliExpress, Amazon, Bing, Booking, Craigslist, Facebook, Google, Instagram, Walmart, Yahoo

- Requests: ~1,000 each

- Location: US

- Targets: AliExpress, Amazon, Bing, Booking, Craigslist, Facebook, Google, Instagram, Walmart, Yahoo

- Requests: ~1,000 each

AliExpress

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 100.00% | 0.00% | 0.00% | 1.59 |

| Bright Data | 99.87% | 0.13% | 0.00% | 1.94 |

| IPRoyal | 100.00% | 0.00% | 0.00% | 0.99 |

| Oxylabs | 100.00% | 0.00% | 0.00% | 1.40 |

| Smartproxy | 99.30% | 0.07% | 0.00% | 1.77 |

Amazon

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 93.86% | 1.28% | 4.86% | 2.58 |

| Bright Data | 70.36% | 2.08% | 27.55% | 2.86 |

| IPRoyal | 77.14% | 0.20% | 22.66% | 2.20 |

| Oxylabs | 95.43% | 2.52% | 2.05% | 2.61 |

| Smartproxy | 95.85% | 0.80% | 3.35% | 2.62 |

Craigslist

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 100.00% | 0.00% | 0.00% | 1.66 |

| Bright Data | 57.26% | 0.20% | 42.54% | 2.35 |

| IPRoyal | 99.93% | 0.07% | 0.00% | 1.12 |

| Oxylabs | 99.94% | 0.06% | 0.00% | 1.16 |

| Smartproxy | 73.12% | 0.00% | 26.88% | 1.56 |

Walmart

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 99.41% | 0.46% | 0.13% | 1.35 |

| Bright Data | 99.87% | 0.13% | 0.00% | 1.94 |

| IPRoyal | 99.94% | 0.06% | 0.00% | 1.07 |

| Oxylabs | 99.68% | 0.32% | 0.00% | 1.03 |

| Smartproxy | 99.87% | 0.07% | 0.00% | 1.30 |

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 96.23% | 1.29% | 2.48% | 3.42 |

| Bright Data | ||||

| GeoSurf | 93.76% | 3.17% | 3.07% | 3.28 |

| IPRoyal | 92.99% | 1.75% | 5.26% | 4.73 |

| NetNut | 1.21% | 98.79% | 0.00% | 2.17 |

| Oxylabs | ||||

| PacketStream | 56.02% | 24.44% | 19.54% | 2.58 |

| RSocks | 89.05% | 10.95% | 0.00% | 3.20 |

| Smartproxy | 92.95% | 2.63% | 4.42% | 1.52 |

| Shifter | 71.70% | 5.34% | 22.96% | 2.34 |

| SOAX | 98.95% | 0.57% | 0.48% | 3.20 |

Bing

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 99.27% | 0.73% | 0.00% | 2.92 |

| Bright Data | 97.29% | 2.71% | 0.00% | 4.25 |

| GeoSurf | 96.50% | 3.50% | 0.00% | 3.27 |

| IPRoyal | 98.36% | 1.64% | 0.00% | 4.65 |

| NetNut | 87.00% | 13.00% | 0.00% | 5.70 |

| Oxylabs | 99.49% | 0.51% | 0.00% | 2.03 |

| PacketStream | 91.51% | 8.49% | 0.00% | 3.64 |

| RSocks | 92.83% | 7.17% | 0.00% | 2.73 |

| Smartproxy | 97.39% | 2.61% | 0.00% | 1.39 |

| Shifter | 95.00% | 4.94% | 0.00% | 2.04 |

| SOAX | 99.00% | 0.62% | 0.00% | 2.59 |

Yahoo

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 99.53% | 0.47% | 2.61 | |

| Bright Data | 99.45% | 0.55% | 3.91 | |

| GeoSurf | 96.99% | 3.00% | 3.12 | |

| IPRoyal | 98.31% | 1.69% | 4.06 | |

| NetNut | 90.47% | 9.52% | 5.46 | |

| Oxylabs | 99.07% | 0.92% | 2.46 | |

| PacketStream | 91.98% | 8.02% | 4.05 | |

| RSocks | 88.71% | 11.29% | 2.90 | |

| Smartproxy | 99.35% | 0.65% | 1.62 | |

| Shifter | 94.95% | 5.05% | 2.20 | |

| SOAX | 99.62% | 0.38% | 2.72 |

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 99.10% | 0.90% | 0.00% | 3.54 |

| Bright Data | 99.13% | 0.87% | 0.00% | 4.03 |

| GeoSurf | 96.03% | 3.97% | 0.38% | 4.18 |

| IPRoyal | 96.66% | 3.34% | 0.00% | 5.62 |

| NetNut | 87.75% | 12.25% | 0.00% | 4.36 |

| Oxylabs | 97.97% | 2.03% | 0.24% | 2.55 |

| PacketStream | 88.00% | 12.00% | 0.00% | 5.25 |

| RSocks | 90.08% | 9.92% | 0.39% | 3.62 |

| Smartproxy | 96.74% | 3.26% | 0.00% | 2.05 |

| Shifter | 95.12% | 4.88% | 0.00% | 2.81 |

| SOAX | 99.31% | 0.69% | 0.00% | 2.97 |

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 99.44% | 0.38% | 0.19% | 3.67 |

| Bright Data | 99.16% | 0.84% | 0.00% | 4.70 |

| GeoSurf | 94.71% | 4.09% | 1.21% | 4.43 |

| IPRoyal | 88.85% | 7.01% | 4.14% | 5.46 |

| NetNut | 87.34% | 11.54% | 1.13% | 4.99 |

| Oxylabs | 96.32% | 2.62% | 1.06% | 2.97 |

| PacketStream | 80.66% | 15.40% | 3.94% | 5.65 |

| RSocks | 88.30% | 8.26% | 3.44% | 3.88 |

| Smartproxy | 94.27% | 3.05% | 2.68% | 1.98 |

| Shifter | 93.51% | 5.83% | 0.67% | 2.98 |

| SOAX | 97.20% | 1.78% | 1.03% | 3.43 |

Booking

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 97.89% | 2.11% | 0.00% | 5.18 |

| Bright Data | 74.07% | 25.93% | 0.00% | 13.48 |

| GeoSurf | 95.85% | 9.39% | 0.00% | 4.98 |

| IPRoyal | 97.46% | 2.54% | 0.00% | 6.46 |

| NetNut | 81.85% | 18.15% | 0.00% | 9.27 |

| Oxylabs | 99.29% | 0.71% | 0.00% | 3.73 |

| PacketStream | 92.88% | 7.12% | 0.00% | 5.19 |

| RSocks | 91.92% | 8.08% | 0.00% | 4.65 |

| Smartproxy | 99.73% | 0.27% | 0.00% | 2.97 |

| Shifter | 94.73% | 5.27% | 0.00% | 3.95 |

| SOAX | 99.13% | 0.87% | 0.00% | 4.41 |

Residential IPs rarely get blocked – unless it’s Amazon or Google. The majority of requests failed due to connection errors, primarily timeouts. Our 30 second timeout threshold is pretty strict, but providers like Oxylabs and SOAX didn’t seem to care. However, it did have a noticeable impact on PacketStream, RSocks, and especially NetNut.

The two hardest targets were Google and Amazon. They caused the largest number of blocks in the form of fake 200 codes (Amazon) and 429 CAPTCHAs (Google). For some reason, NetNut’s results were catastrophic with Google, where only 1% of the requests reached the target. We even double checked if targeting Google was allowed. It was. Craigslist caused issues for IPRoyal, and providers faced some blocks by Instagram; otherwise, all did well.

Smartproxy performed the best with popular websites. The provider had shown strong results already in our general benchmarks. But for some reason, it did particularly well with target tests: the success rate remained high and the response time beat all other competitors.

Bright Data gave us a proxy-based API instead, which didn’t always work out. The provider insisted that we use Web Unlocker which adds extra web scraping features onto the proxy network. It was obviously optimized for websites like Amazon but slowed to a crawl against Walmart and Craigslist. This reduced the overall response time by a lot. On the other hand, Bright Data was the only provider with zero blocks. So maybe its strengths would have shown better on a larger scale.

Features

A provider’s features determine how well the proxy network can adapt to particular needs of the user. If an IP pool includes addresses from Italy, but provides no method to target them, this will make it impossible to track keywords reliably or test an application in that location. If the proxy IPs have inconvenient rotation options, it will require extra development effort to customize them as needed. You get the drift.

By features, we primarily mean the following functionality:

- Location coverage and the ability to filter them.

- IP rotation options that either enable the famous unlimited scaling of residential IPs or allow creating sticky sessions.

- Supported protocols, namely HTTP(S) and SOCKS5.

- Authentication options like username and password, as well as creating sub-users.

| Provider | Available Countries | Country filter | State filter | City filter | ASN filter |

|---|---|---|---|---|---|

| Blazing SEO | 100+ | ✅ | |||

| Bright Data | 150+ | ✅ | ✅ | ✅ (paid) | ✅ (paid) |

| GeoSurf | 150+ | ✅ | ✅ | ✅ | |

| IPRoyal | 137 | ✅ | ✅ | ✅ | |

| NetNut | 150+ | ✅ | ✅ | ✅ | |

| Oxylabs | 150+ | ✅ | ✅ | ✅ | ✅ (paid) |

| PacketStream | 129 | ✅ | |||

| RSocks | 150+ | ✅ | |||

| Smartproxy | 150+ | ✅ | ✅ | ✅ | |

| Shifter | 150+ | ✅ (paid) | ✅ (paid) | ||

| SOAX | 150+ | ✅ | ✅ | ✅ | ✅ |

| Provider | Every request | Sticky session | Time intervals |

|---|---|---|---|

| Blazing SEO | ✅ | ✅ | As long as available |

| Bright Data | ✅ | ✅ | Customizable with Proxy Manager |

| GeoSurf | ✅ | ✅ | 1 min, 10 mins, 30 mins |

| IPRoyal | ✅ | ✅ | 1 second - 24 hours |

| NetNut | ✅ | ✅ | As long as available |

| Oxylabs | ✅ | ✅ | 10 mins, 30 mins |

| PacketStream | ✅ | ✅ | As long as available |

| RSocks | ✅ | 15 mins | |

| Smartproxy | ✅ | ✅ | 1 min, 10 mins, 30 mins |

| Shifter | ✅ | 5-60 mins | |

| SOAX | ✅ | 90-600 sec |

| Provider | HTTP(S) | SOCKS5 |

|---|---|---|

| Blazing SEO | ✅ | ✅ |

| Bright Data | ✅ | ✅ |

| GeoSurf | ✅ | |

| IPRoyal | ✅ | ✅ |

| NetNut | ✅ | |

| Oxylabs | ✅ | |

| PacketStream | ✅ | |

| RSocks | ✅ | ✅ |

| Smartproxy | ✅ | |

| Shifter | ✅ | ✅ |

| SOAX | ✅ | ✅ |

| Provider | Credentials | IP Whitelisting | Sub-Users |

|---|---|---|---|

| Blazing SEO | ✅ | Resellers only | |

| Bright Data | ✅ | ✅ | ✅ (50, more paid) |

| GeoSurf | ✅ | ✅ | |

| IPRoyal | ✅ | ✅ | Resellers only |

| NetNut | ✅ | ✅ (bigger plans) | ✅ (unlimited) |

| Oxylabs | ✅ | ✅ | ✅ (up to 3) |

| PacketStream | ✅ | Resellers only | |

| RSocks | ✅ | ||

| Smartproxy | ✅ | ✅ | ✅ (up to 5 for non-reseller plans) |

| Shifter | ✅ | Resellers only | |

| SOAX | ✅ | ✅ | Resellers only |

- Does not allow reselling: Bright Data, GeoSurf, RSocks

- Allows reselling: everyone else

150+ countries and city targeting are becoming a standard, ASN filtering remains a luxury. Most providers offers country-level out of the box. Only Shifter has this functionality as an upsell (in 2022!). City targeting has become a commodity as well. ASN filtering, however, is a different matter. Out of the few providers that offer it, only SOAX does so for free. Bright Data, on the other hand, charges double (!) the regular price.

The question whether to allow filtering ASNs is as much political as it’s technical. Small proxy pools simply don’t have enough IPs to ensure a good user experience. Providers realize that and are cautious. It could also be the case of protecting the proxy network.

Everyone supports sticky sessions, some less flexible than others. There are three approaches: as long as available (PacketStream, NetNut), fixed time intervals (Oxylabs, Smartproxy), or highly customizable (SOAX, IPRoyal). Newer providers tend to prefer the third approach. We’ve also seen proxy sellers that force rotation after a specific amount of requests, but none of the participants practice this (except maybe for Bright Data with its Proxy Manager).

On the other hand, rotation on every connection request is almost universal. Shifter’s method is the most limiting, as it charges for ports and only rotates IPs every five minutes. It caused us to omit some of the tests because even with a $10,000 plan, we couldn’t complete them on time.

Nearly half of the providers still don’t have SOCKS5. More particularly, five out of 11 providers allow connecting via HTTP(S) only. It’s interesting that most of them are older companies; we could assume they either haven’t found the need to implement SOCKS5 or decided against it after calculating the benefits and risks. Newer providers think otherwise: they both support SOCKS5 and make it easily accessible (unlike Bright Data, which requires additional software to enable the functionality).

Both authentication methods are common, sub-users come with reseller plans. Only PacketStream fails to support IP whitelisting. Shifter and RSocks have it the other way around: that’s the only authentication method they offer. Knowing that it’s not ideal for users with dynamic IPs, both have implemented workarounds. Shifter gives 100 whitelist slots hoping that they’ll be enough, while RSocks has built a piece of software that periodically re-authenticates the address.

Providers aren’t keen on allowing sub-users for their regular clients. The ones that do mostly serve premium customers that are likely to need proxies for multiple projects. Having separate users helps to keep their traffic use and expenses clear.

Resellers are welcome. Eight out of 11 participants support reselling or have white-label programs. Three don’t, but their reasons differ. Whereas Bright Data has an explicit no-reselling policy, RSocks probably can’t resell because it’s already a reseller and the source forbids it. And GeoSurf, to our knowledge, simply doesn’t allow it.

Price

Residential proxies stand in the middle of the pricing ladder: they’re cheaper than mobile or ISP addresses, but more expensive than datacenter IPs.

It’s impossible to price residential proxies by IP address, so providers offer data-capped monthly plans instead. This isn’t a hard requirement: you can find plans without traffic limits, as well as services that impose no time commitments. They’re simply rarer.

The price of residential proxies depends on how providers position themselves. Companies that target smaller clients will have low entry thresholds and cheaper prices per gigabyte. Premium providers cost more and start higher up, but they also scale well (sometimes even outscaling the cheap providers at terabytes of data). That’s why the market can support so many sneaker proxy and general-purpose resellers.

Let’s have a look at what strategies the providers choose and how they position themselves in the market.

| Provider | Model | Duration | Upsells |

|---|---|---|---|

| Blazing SEO | Traffic | Month, year | – |

| Bright Data | Month, year, pay as you go | City, ASN targeting, exclusive IPs | |

| GeoSurf | Month, year | – | |

| IPRoyal | Pay as you go | – | |

| NetNut | Month, year | Whitelisted IPs, scraping API, city selection, acc. manager | |

| Oxylabs | Month, year | ASN targeting, acc. manager | |

| PacketStream | Pay as you go | – | |

| RSocks | Month | More whitelisted IPs, threads | |

| Smartproxy | Month, year | More sub-users, whitelisted IPs | |

| Shifter | Ports | Month, year | Country selection, premium targets |

| SOAX | Traffic + ports | Month | More ports, whitelisted IPs, API |

| Provider | 5 GB | 20 GB | 50 GB | 100 GB | 250 GB | 1,000 GB |

|---|---|---|---|---|---|---|

| Blazing SEO | $15.00/GB | $12.50/GB | $7.00/GB | $6.00/GB | $5.00/GB | $3.50/GB |

| Bright Data | $25.00/GB | $15.00/GB | $12.50/GB | $10.00/GB | $10.00/GB | $8.50/GB |

| GeoSurf | $12.00/GB | $10.00/GB | $8.00/GB | |||

| IPRoyal | $2.85/GB | $2.70/GB | $2.40/GB | $2.10/GB | $1.80/GB | $1.20/GB |

| NetNut | $18.00/GB | $15.00/GB | $12.00/GB | $8.00/GB | $6.50/GB | $4.00/GB |

| Oxylabs | $15.00/GB | $12.00/GB | $9.00/GB | $5.00/GB | ||

| PacketStream | $1.00/GB | $1.00/GB | $1.00/GB | $1.00/GB | ||

| RSocks | $6.00/GB | $5.00/GB | $3.00/GB | |||

| Smartproxy | $15.00/GB | $10.00/GB | $8.00/GB | $7.00/GB | $6.00/GB | $4.00/GB |

| SOAX | $12.00/GB | $9.00/GB | $7.00/GB | |||

| Average | $13.64/GB | $10.90/GB | $8.43/GB | $5.74/GB | $4.79/GB | $3.89/GB |

| Trial | Refund | Both | None |

|---|---|---|---|

| Blazing SEO | Smartproxy | Bright Data | PacketStream |

| NetNut | Shifter | Oxylabs | IPRoyal |

| RSocks | GeoSurf | ||

| SOAX |

Providers prefer a traffic-based subscription model. It keeps the IP pool cleaner and, from our experience, ensures better performance. Even RSocks, which is famous for unlimited-traffic residential proxy lists, gave us its metered service in an effort to compete in quality. Shifter is the only participant that chooses to charge for ports, while SOAX combines the two approaches.

Pay as you go is still rare. Instead, providers stick to the subscription model. Most offer to buy extra traffic at a fixed rate if a plan proves too limiting but not enough for the next tier. Yearly contracts cut the price by around 15%. Pay as you go is mostly used by the affordable providers, PacketStream and IPRoyal. Bright Data cleverly combines both models: you can pay as you go at a premium rate until you reach cheaper monthly commitment thresholds.

Better-paying clients get more features. For example, Bright Data charges twice (!) for city and ASN targeting, while Smartproxy sells more sub-users. Many of the extra features are unlocked by getting larger plans. NetNut is the most obvious example, as it not only enables city targeting, assigns an account manager, but also provides access to a web scraping API. A curious choice not to sell it as a separate product.

Providers fall into three pricing tiers. They are:

- Cheap: PacketStream, IPRoyal, RSocks.

- Mid-level: Smartproxy, SOAX, Blazing SEO.

- Premium: everyone else.

The difference between these pricing tiers can be staggering. At 50 GBs of traffic, Bright Data costs 12.5 times more than PacketStream.

However, the gap shrinks as the usage scales up. For example, NetNut highly incentivizes volume use, and it starts picking up at 1 TB of data and further. Smartproxy and SOAX both strike a good balance, though SOAX’s plans are best suited for small business use.

It’s interesting – and pretty bizarre – that most of the cheapest providers offer terabyte-scale plans and even encourage reselling. It’s even more bizarre that one of them likely does resell the other. Their limited pool sizes and low prices don’t bode well for IP quality.

There’s no one approach for letting customers test residential IPs. Trials may seem like the most popular option, but they’re preferred by premium services and handed out to businesses. They can also come on condition: for RSocks, you have to leave a good review on TrustPilot; for SOAX, the trial is paid ($1.99). PacketStream and IPRoyal officially don’t offer trials or refunds, though the former does hand out credit on forums like BlackHatWorld.

Here’s our evaluation of the providers based on the aspects covered:

The graphs are telling: most providers, even the cheapest ones, perform relatively well. While premium companies like Oxylabs and Bright Data still lead the pack, there are no longer huge differences in how well the infrastructure works. Features are mostly not an issue, as well: SOAX and IPRoyal bring much of the same functionality at a lower price point.

The real differences reveal themselves in the proxy pools. As a rule, premium providers had both larger and better-balanced IP networks. The disparity in numbers between Oxylabs and PacketStream reached 2.5 times in all locations, and more than 10 times counting US-only addresses. This will have a noticeable, whether in IP quality or experience targeting less popular locations.

PacketStream has gained strong competitors in the affordable segment. For now, IPRoyal basically sells the same proxy pool; but the provider offers more features and has laid the groundwork to grow its own proxy network. RSocks’ service is surprisingly competitive for the price.

Overall, Bright Data and Oxylabs still have the best residential proxy services, and Smartproxy remains the best value choice. Despite some imperfections, SOAX and NetNut continue being great alternatives in most areas. SOAX offers excellent functionality free of charge but is held back by its proxy pool, while NetNut suffers from minor imperfections in several areas.

As for the others, GeoSurf remains a viable premium choice – it had a pretty balanced proxy pools but didn’t stand out much. Blazing SEO hasn’t left the beta; and despite its respectable performance, the provider’s proxy pool at this time is much too small for any larger tasks.

Mobile Proxies

Few providers offer peer-to-peer mobile proxy networks. They’re hard to source, have data use restrictions, and cost a lot of money. Providers, mostly smaller, turn to dongle-based mobile IPs to counteract these issues. Still, mobile proxy pools have their uses, especially when there’s a need for location variety or larger-scale automation.

Three out of the four providers in the research base their mobile proxies on peer-to-peer networks. Blazing SEO currently uses a different approach: it mixes dedicated devices with IPs borrowed from other people. As we’ll see, this method works but has some implications for a web scraping-oriented service.

The section mostly mirrors the structure of residential proxies. You’ll find it divided into four parts (click on them to expand):

Proxy Pool

Peer-to-peer mobile proxies follow all the same conventions as residential IPs: large, fluctuating proxy pools with IPs that come and go. The main difference here is that the proxy peers are connected to mobile carriers and not fixed line networks.

Considering this, we made all the same benchmarks, only on a slightly smaller scale. They measure:

- How many unique IPs the providers have globally.

- How many IPs they control in seven high-value locations.

- What percentage of those IPs is really mobile.

| Provider | Monthly IPs |

|---|---|

| Blazing SEO | |

| Bright Data | 7,000,000.00 |

| SOAX | 3,500,000.00 |

| Oxylabs | 20,000,000.00 |

- Locations: All

- Requests: 150,000 over 14 days

- Locations: US, UK, Germany, France, Russia, Canada, Australia

- Duration: 14 days; CA, AU 7 days

- Requests: 150,000 each; CA, AU 50,000 each

IPs categorized as belonging to a mobile carrier or a company that sells both landline and mobile services.

| Provider | Global | US | UK | DE | FR | RU | CA | AU |

|---|---|---|---|---|---|---|---|---|

| Blazing SEO | 100.00% | |||||||

| Bright Data | 95.35% | 92.63% | 96.04% | 97.79% | 97.06% | 95.13% | 99.41% | 98.69% |

| Oxylabs | 91.72% | 96.68% | 95.53% | 98.04% | 95.79% | 95.31% | 87.91% | 98.76% |

| SOAX | 93.77% | 95.27% | 94.73% | 97.43% | 98.04% | 94.31% | 82.31% | 97.35% |

Oxylabs advertises the largest mobile proxy pool. In theory, it’s nearly three times larger than the closest competitor Bright Data, and more than five times the size of SOAX.

Blazing SEO has no number beside it. Why? Dongle-based mobile proxies follow different rules than peer-to-peer networks. They have few IPs available at the same time – as many as there are devices. But they can force mobile carriers to assign new IPs by restarting the devices, which results in thousands of unique IP addresses over time.

Advertised IP numbers don’t always reflect real proxy count. Oxylabs did have the most unique IPs throughout all locations, but the difference wasn’t as big as the advertised numbers would suggest. What really surprised us, though, was that SOAX actually returned more IPs than Bright Data. It stands to reason that we shouldn’t take the official numbers for granted.

Oxylabs dominates high-value locations, Bright Data underperforms. Benchmarks with individual locations brought out the differences. Oxylabs clearly dwarfed the other providers, especially in the US. Blazing SEO had a fair number of American proxies, too – frankly, more than in its residential pool. But remember: very few of the IPs are available at the same time.

However, Bright Data once again disappoints. SOAX clearly had more proxies to work with, even without its large Russian presence. In the US, the difference was more than double. Either we caught Bright Data during a bad spell, or one of these providers should update their IP numbers.

Providers don’t lie about selling mobile proxies. There were no alarms and no surprises. All four providers seemed to be truthful about their IPs being mobile.

Proxy Performance

The mobile proxy pools had to go through similar benchmarks as the residential IP networks. They answer two questions:

- How reliably the proxy infrastructure can connect to a target (success rate).

- How long it takes to establish a connection (response time).

Once again, the benchmarks were based on hundreds of thousands of requests, so their scale allows making pretty confident assumptions about the services. Only our target tests that accessed popular websites were made on a smaller scale.

- Target: Cloudflare

- Locations: Global

- Requests: 150,000

- Target: Cloudflare

- Locations: Global

- Requests: 150,000

- Target: Cloudflare

- Locations: US, UK, DE, FR, RU, CA, AU

- Requests: 150,000 each; CA, AU 50,000 each

| Provider | US | UK | DE | FR | RU | CA | AU |

|---|---|---|---|---|---|---|---|

| Blazing SEO | 7.13 | ||||||

| Bright Data | 2.59 | 1.87 | 2.12 | 1.63 | 1.92 | 2.07 | 2.84 |

| Oxylabs | 1.60 | 1.29 | 1.26 | 1.20 | 1.51 | 1.83 | 2.46 |

| SOAX | 3.52 | 3.33 | 3.20 | 3.30 | 2.87 | 2.96 | 2.97 |

Three out of four participants had nearly perfect success rates. Compared to our experience with mobile IPs years before, providers have perfected their mobile proxy infrastructure to work nearly without fail. That might be an exaggeration, and I’m sure that customers have their stories. But in general, the services have improved greatly.

Blazing SEO was the only participant out of the 4 that had some hiccups. But it’s also a very new product for the provider, so these issues will get sorted with time.

Some providers are two – and even four – times faster than others. Mobile proxies connect to websites around half as fast as residential IPs. But whether you’ll find them adequate or slow highly depends on the provider. For example, Oxylabs’ response time is faster than seven out of the 11 residential (!) proxy networks. Bright Data and SOAX were slower but still decently fast. However, we can’t say the same about Blazing SEO: Oxylabs beat it by four, Bright Data three, SOAX by two times.

All providers displayed the best results in Europe. Bright Data favored France, Oxylabs UK and Germany, while SOAX had the best speed in Russia. Oxylabs was the only provider with a response time of fewer than two seconds in the US.

- Location: US

- Targets: AliExpress, Amazon, Bing, Booking, Craigslist, Facebook, Google, Instagram, Walmart, Yahoo

- Requests: ~1,000 each

- Location: US

- Targets: AliExpress, Amazon, Bing, Booking, Craigslist, Facebook, Google, Instagram, Walmart, Yahoo

- Requests: ~1,000 each

Amazon

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 62.14% | 34.09% | 3.77% | 11.82 |

| Bright Data | 95.15% | 1.35% | 3.50% | 4.55 |

| Oxylabs | 89.28% | 3.13% | 7.59% | 4.99 |

| SOAX | 91.75% | 3.61% | 4.65% | 5.92 |

AliExpress

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 69.88% | 30.12% | 0% | 10.57 |

| Bright Data | 97.46% | 2.54% | 0% | 4.14 |

| Oxylabs | 96.97% | 3.03% | 0% | 3.55 |

| SOAX | 96.74% | 3.26% | 0% | 4.54 |

Craigslist

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 51.98% | 48.02% | 0.00% | 13.99 |

| Bright Data | 96.18% | 3.82% | 0.00% | 5.43 |

| Oxylabs | 98.90% | 0.88% | 0.22% | 4.70 |

| SOAX | 96.96% | 3.04% | 0.00% | 5.11 |

Walmart

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 61.77% | 38.23% | 0.00% | 12.21 |

| Bright Data | 98.00% | 2.00% | 0.00% | 4.05 |

| Oxylabs | 95.57% | 4.36% | 0.07% | 3.65 |

| SOAX | 96.27% | 3.73% | 0.00% | 4.60 |

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | ||||

| Bright Data | ||||

| Oxylabs | ||||

| SOAX | 96.07% | 3.18% | 0.75% | 4.55 |

Bing

| Provider | Success Rate | Errors | Blocks | Response Time |

|---|---|---|---|---|

| Blazing SEO | 69.24% | 30.76% | 0.00% | 10.35 |